AP Photo/Ryan Sun

A cashier at the International Market in Point Roberts displays a till for U.S. Dollars and Canadian Dollars, Saturday, March 1, 2025, in Point Roberts, Wash.

President Trump imposed significant tariffs on goods from Mexico, China and Canada–three of the United States’ largest trade partners at the beginning of March and has since followed up with an additional tariff on all countries.

While the full impact of these tariffs is yet to be seen, the definitions, statistics and advice from economic experts may help people understand what to expect.

What is Happening Now?

According to executive orders 14193, 14194, and 14195, these tariffs have been issued to put pressure on the governments of China, Mexico and Canada to address the issues of illegal immigration and drug trafficking.

His latest actions include a 10% tariff on all countries and proposed plans for additional tariffs on various items such as liquor imported from the European Union and an additional 50% tariff on Chinese goods

Mexico and Canada: There’s a 25% tax or tariff on most goods imported the North American trading partners. The tariffs have been paused on goods that meet the U.S. Mexico and Canada Agreement rules of origin, an open trade agreement between the three countries that has been in effect since July 2020, until April 2. There’s a 10% tariff on energy products from Canada and potash from both countries.

China: In February, a 10% tariff was imposed on all goods from China

Steel and Aluminum: Trump has also imposed a 25% tariff on steel, aluminum, and some products made of those materials from all countries including several countries that had previously been exempt from American steel and aluminum tariffs.

Response: Multiple governments affected by these tariffs have announced or enacted retaliatory tariffs on the U.S. including Mexico, Canada, China, and the European Union. China is already set to impose a 34% tariff on all U.S. goods as well as some additional trade restrictions on April 10. In turn, Trump threatened to impose even more tariffs such as a 200% tax on alcohol from the EU which he posted about on Truth Social. The back and forth between these major nations is causing some experts to call it a trade war.

What is a Tariff?

Tariffs are one of the oldest forms of trade policy and the primary source of revenue for the U.S. government before the income tax was implemented, said Dr. Rishav Bista, an associate professor of international trade and macroeconomics at TCU.

Essentially, a tariff places a tax on specific goods from certain countries which the government collects as they are imported. Anyone who imports these goods has to pay the tax in addition to the original cost. This makes it more expensive for companies to buy materials and produce goods to sell to their consumers.

How will this impact the Economy?

Some major companies are already predicting trouble for the U.S. economy and their own production costs. When asked about the tariffs, Jim Farley, the CEO of Ford Motor company said “If you look at the tariffs, let’s be real honest, long term, a 25% tariff across the Mexico and Canadian border will blow a hole in the U.S. industry that we have never seen.”

In an article in the Wall Street Journal Douglas Irwin, an economist at Dartmouth College said that due to the number and size of the tariffs indicate an unprecedented amount of trade tensions in the U.S. In the weeks since the first rounds of tariffs went into effect, the U.S. stock market has also dropped as investors worry about the market impact. With the addition of the 10% overall tariff, the stock market has fallen even further with the Dow Jones Industrial Average reporting a decline of over 2,200 points as of April 4.

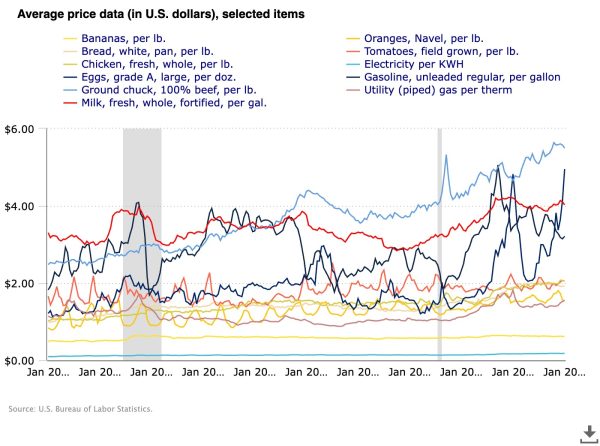

Many companies will also see a rise in production costs due to the increased price of imported goods and materials, Bista said. This increased cost will then be passed on to consumers in the form of higher prices on all kinds of goods from automobiles to gasoline to your weekly groceries. This is compounded by the lingering inflation caused by the COVID-19 pandemic and the war in Ukraine, driving the price of goods even higher.

Key areas to look out for

Not every industry will be impacted equally by these tariffs. However, there are many areas where consumers can expect to see a significant price increase.

Some specific areas for consumers to look out for include steel and aluminum products such as drinks in aluminum cans, cars, etc. since roughly half of all aluminum and a quarter of all steel in America is imported.

According to an article on Forbes online fresh produce such as avocados, strawberries, and tomatoes that are imported in large amounts from Mexico will also become much more expensive. The article also listed a variety of other groceries that might become more expensive such as grains, meat, frozen vegetables, beer, tequila, cocoa, and biscuits/wafers all of which are often imported from Canada and Mexico.

Energy sources imported from Canada such as oil, natural gas, and electricity will also be subjected to a 10% tax.

The blanket tariff will also impact many companies such as Apple Inc. who manufacture and import many components of their products from countries such as China and India.

Who will be impacted and what can we do?

At the corporate level, some companies are already looking for ways to mitigate increased production costs in order to avoid raising the price of their products. In a corporate earnings call last month, James Quincey, the CEO of Coca-Cola said, “if aluminum cans become more expensive, we can put more emphasis on PET bottles, et cetera, et cetera. So, we will adapt the packaging strategy in function of changes in the relative input costs of what goes into that.”

As consumers, there isn’t much the average American can do to combat the change in the U.S. economy. “Studies show that consumers with lower income levels spend disproportionately more of their income on food and manufactured goods,” Bista said, “Therefore, consumers with lower levels of income stand to lose more due to these tariffs.”

However, anyone looking to mitigate the impact of inflation tariffs should look to increase their real income, Bista said. Specifically, Americans should try to increase their real income, the amount of money earned after taking inflation into account. This ensures that your income increases as inflation increases so that daily purchases are still affordable. People can also invest their money in a high interest savings account which will keep the value of their savings constant.